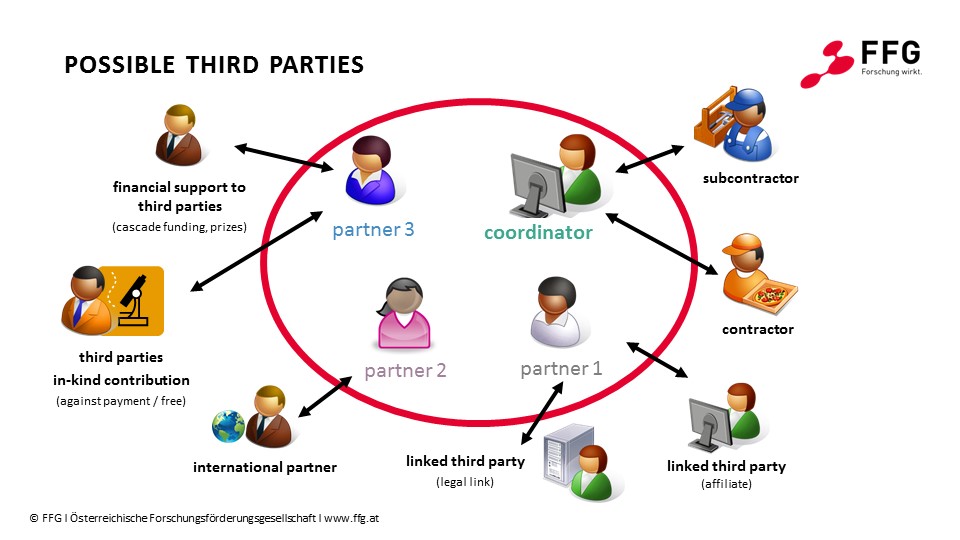

Subcontracting (article 13 GA)

Detailed information can be found on our thematic page "Subcontracting".

Contracts (article 10 GA)

Detailed information can be found on our thematic page "Costs of other goods and services".

Linked third parties (article 14 GA)

Linked third parties carry out tasks within the project themselves and declare their own costs (non-profit rule!) in a separate financial statement.

They are subject to the same eligibility rules as the beneficiaries. Linked third parties are eligible if they are indicated in the Grant Agreement (GA) together with their tasks. Linked third parties may only be parent/subsidiary/associated companies of a beneficiary ("affiliates") as well as organisations with a legal link to a beneficiary.

Third parties providing in-kind contributions (articles 11 and 12 GA)

Third parties providing in-kind contributions provide in-kind contributions to a beneficiary.

Such in-kind contributions may consist of e.g. equipment or research infrastructure, or persons (employed by the third party and working for the beneficiary - eligible under the category "costs for personnel seconded by a third party"). Please note: Staff provided by a temporary work agency is not charged under the personnel costs but under "other goods and services".

The costs eligible are the actual costs incurred by the third party for the in-kind contributions - even if the beneficiary has received the in-kind contribution free of charge (i.e. without payment for the in-kind contribution).

In any case, the third party and the type of in-kind contribution must be indicated in the GA.

International Partners (article 14a GA)

These are organisations that are not eligible for funding (i.e. legal entities established in a third country not listed in Annex A to the Horizon 2020 Work Programme 2018-2020 or international organisations without European interest (art. 2.1(12) of the Horizon 2020 Rules for Participation)).

Their estimated costs need to be indicated in the project budget (Annex 2 of the GA), but will not be reimbursed and will not be taken into account for the calculation of the grant amount.

Please note: International Partners are not beneficiaries. But they perform action tasks directly without receiving funding from the EU Commission.

Financial support to third parties (article 15 GA)

Third parties may receive financial support from the project budget in the form of fellowships, prizes etc. only if this is explicitly foreseen in the work programme and if article 15 is shown as an option in the GA. If this is the case the following minimum requirements must be met:

- maximum amount of EUR 60,000 per third party

- criteria for calculating the exact amount of financial support

- a closed list of the types of activities that qualify for financial support

- the (groups of) persons that may receive financial support AND

- the general criteria for giving financial support

Non-compliance with the requirements mentioned above may lead to a reduction of the grant.

More information about the specific prerequisites can be found in article 15.2 GA as well as in the document “Guidance note on financial support to third parties under H2020".

| Type of third party | Works on action tasks (Annex 1)? | Provides resources or services for the action | What is eligible? | Indicated in Annex 1? | Indirect costs? | Selecting the third party | GA art. |

|---|---|---|---|---|---|---|---|

| subcontractor | yes | no | price | yes | no | best value for money no conflict of interest |

13 |

| contractor | no | yes | price | no | yes | best value for money no conflict of interest |

10 |

| linked third party | yes | no | costs | yes | yes | affiliate or legal link eligible for funding |

14 |

| international partner | yes | no | / | yes | / | not eligible for funding | 14a |

| third party providing in-kind contributions | no | yes | costs | yes | yes | not used to circumvent the rules | 11, 12 |

| financial support to third parties | participation in the action as recipients only when explicitly foreseen in the call text | participation in the action as recipients only when explicitly foreseen in the call text | support given | yes | no | according to the conditions in Annex 1 | 15 |

Questions & Answers

Question: Can a beneficiary simultaneously be a third party of another beneficiary in the same action?

Answer: No.

Explanation: Third parties are organisations that do not sign the GA, beneficiaries do. Therefore an organisation can not simultaneously be a beneficiary and a third party (= “non-beneficiary”).

Question: Can a beneficiary simultaneously be a subcontractor of a linked third party of another beneficiary?

Answer: No.

Explanation: Subcontracting between beneficiaries of the same action are not eligible. Since linked third parties are subject to the same cost reporting rules as the beneficiaries, this rule must be applied accordingly.

Question: Can a linked third party charge itself costs of contracts, subcontracts and in-kind contributions?

Answer: Yes.

Explanation: Linked third parties are subject to the same cost reporting rules as the beneficiaries. They can therefore also charge the costs of contracts, subcontracts and in-kind contributions.

Question: How should the costs of linked third parties be allocated in the proposal?

Answer: In principle, the costs of a linked third party should be allocated to the beneficiary to which it is linked (i.e. personnel costs of the linked third party are added to the personnel costs of the beneficiary; other direct costs of the linked third party are added to the other direct costs of the beneficiary etc.)

Exception: In Innovation Actions (IA), the costs of the linked third party must be specified separately from the costs of the beneficiary.

Question: Do beneficiaries have to consider anything special when involving third parties?

Answer: Yes, as third parties do not sign the GA, solely the beneficiary remains responsible towards the EU Commission for the third party. Furthermore, beneficiaries must ensure that the third party does comply with certain obligations from the GA (e.g. controls by the EU Commission conducted at the third party). Therefore it is recommended to conclude a contract between the beneficiary and the third party. In this respect you may use our Sideletter as template.

More information can found ...

- in the Annotated Grant Agreement (AGA), article 8 - article 15.

Contact